The Legal System Surrounding Financial Offshore Fiscal Planning Approaches

The Legal System Surrounding Financial Offshore Fiscal Planning Approaches

Blog Article

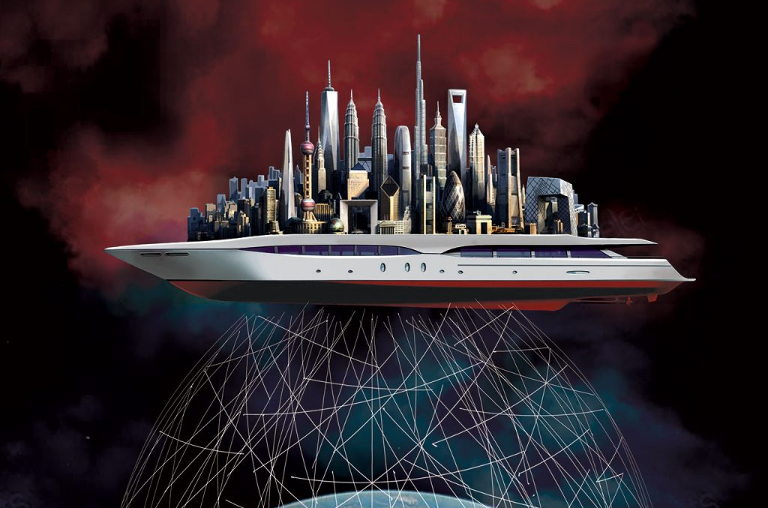

Understanding the Relevance of Financial Offshore Accounts for Company Growth

In the dynamic globe of international commerce, economic offshore accounts stand as crucial tools for business growth, providing not just improved money flexibility yet likewise potential decreases in transaction prices. These accounts facilitate access to diverse markets, enabling companies to take advantage of far better rate of interest and tax obligation effectiveness. The strategic application of such accounts calls for a nuanced understanding of legal frameworks to make sure conformity and maximize benefits. This complexity invites additional expedition right into how services can properly harness the advantages of offshore banking to drive their growth efforts.

Secret Benefits of Offshore Financial Accounts for Services

While many organizations seek affordable advantages, using overseas financial accounts can give considerable benefits. These accounts contribute in assisting in global profession by enabling firms to manage numerous currencies extra effectively. This capacity not only simplifies deals yet can likewise lower the transaction costs that accumulate when taking care of international exchanges. In addition, offshore accounts commonly offer much better rates of interest contrasted to domestic banks, improving the possibility for earnings on idle funds.

In addition, geographical diversity intrinsic in offshore banking can function as a threat administration device. By spreading out possessions throughout various territories, services can secure versus regional economic instability and political risks. This strategy ensures that the firm's resources is shielded in differing market conditions. Lastly, the privacy provided by some overseas territories is a critical variable for services that focus on confidentiality, especially when dealing with delicate deals or exploring brand-new endeavors.

Legal Factors To Consider and Compliance in Offshore Financial

Although offshore monetary accounts provide countless benefits for organizations, it is necessary to understand the lawful structures and compliance needs that govern their usage. Each territory advice has its own set of regulations and regulations that can dramatically impact the efficiency and validity of offshore financial tasks. financial offshore. Businesses need to guarantee they are not only conforming with the regulations of the country in which the offshore account lies but likewise with international monetary regulations and the regulations of their home nation

Non-compliance can lead to serious legal effects, consisting of penalties and criminal charges. It is vital for businesses to engage with legal experts who focus on global money and tax law to navigate these complicated legal landscapes successfully. This advice helps ensure that their offshore banking activities are carried out lawfully and fairly, lining up with both global and nationwide criteria, hence safeguarding the company's credibility and monetary health and wellness.

Methods for Incorporating Offshore Accounts Into Organization Operations

Integrating overseas accounts into business procedures needs careful preparation and tactical implementation. It is essential to pick the best territory, which not just you can try these out aligns with the organization goals yet additionally provides financial and political stability.

Companies need to integrate their overseas accounts into their total economic systems with openness to preserve count on among stakeholders (financial offshore). This entails establishing up durable bookkeeping techniques to report the circulation and track of funds properly. Regular audits and evaluations should be carried out to alleviate any threats connected with offshore financial, such as fraud or reputational damage. By carefully executing these approaches, companies can successfully utilize offshore accounts to sustain their growth initiatives while sticking to lawful and ethical criteria.

Final Thought

In final thought, offshore financial accounts are essential properties for services aiming to expand around the world. Incorporating them right into service click to investigate procedures tactically can significantly enhance cash flow and straighten with wider organization growth purposes.

In the dynamic globe of global commerce, monetary overseas accounts stand as crucial devices for service growth, providing not only improved money versatility however likewise potential decreases in purchase expenses.While numerous companies seek affordable benefits, the use of offshore financial accounts can give substantial benefits.Although offshore economic accounts use various benefits for organizations, it is important to understand the lawful structures and compliance needs that control their use. Companies should ensure they are not just abiding with the legislations of the country in which the overseas account is situated but additionally with worldwide monetary regulations and the laws of their home nation.

Report this page